In today’s competitive venture capital landscape, raising funds efficiently requires more than just a strong portfolio—it demands strategic connections and sophisticated outreach. When a leading UK-based venture capital firm specializing in tech and AI approached SocialScape to accelerate their Series C round, we delivered exceptional results that exceeded expectations.

The Challenge: Beyond Traditional Fundraising

The VC firm faced critical hurdles that many in the industry encounter:

- Limited Network Reach: Despite a strong track record in tech and AI investments, their internal network couldn’t efficiently tap into diverse funding sources.

- Sustainable Growth Needs: The firm needed more than a one-time capital injection—they required a systematic approach to build lasting investor relationships.

Our Solution: The SocialScape Advantage

We deployed our comprehensive fundraising acceleration strategy, combining AI-powered technology with high-touch relationship building.

Phase 1: Strategic Network Activation

Our AI-driven investor acquisition system identified and engaged perfect-fit investors across multiple categories:

- Family Offices seeking tech exposure

- Ultra-High-Net-Worth Individuals with prior VC experience

- Registered Investment Advisors specializing in alternative investments

- Strategic Funds of Funds aligned with the firm’s investment thesis

The key difference? Our targeting went beyond basic pattern matching. We analyzed investor behavior, investment history, and strategic alignment to ensure every introduction had maximum potential for conversion.

Phase 2: Building Sustainable Infrastructure

While securing immediate funding, we simultaneously strengthened the firm’s long-term fundraising capabilities:

- Created a proprietary investor engagement framework

- Implemented automated nurture sequences for ongoing relationship management

- Developed data-driven approaches to identify and qualify potential investors

- Established systematic processes for managing investor relationships

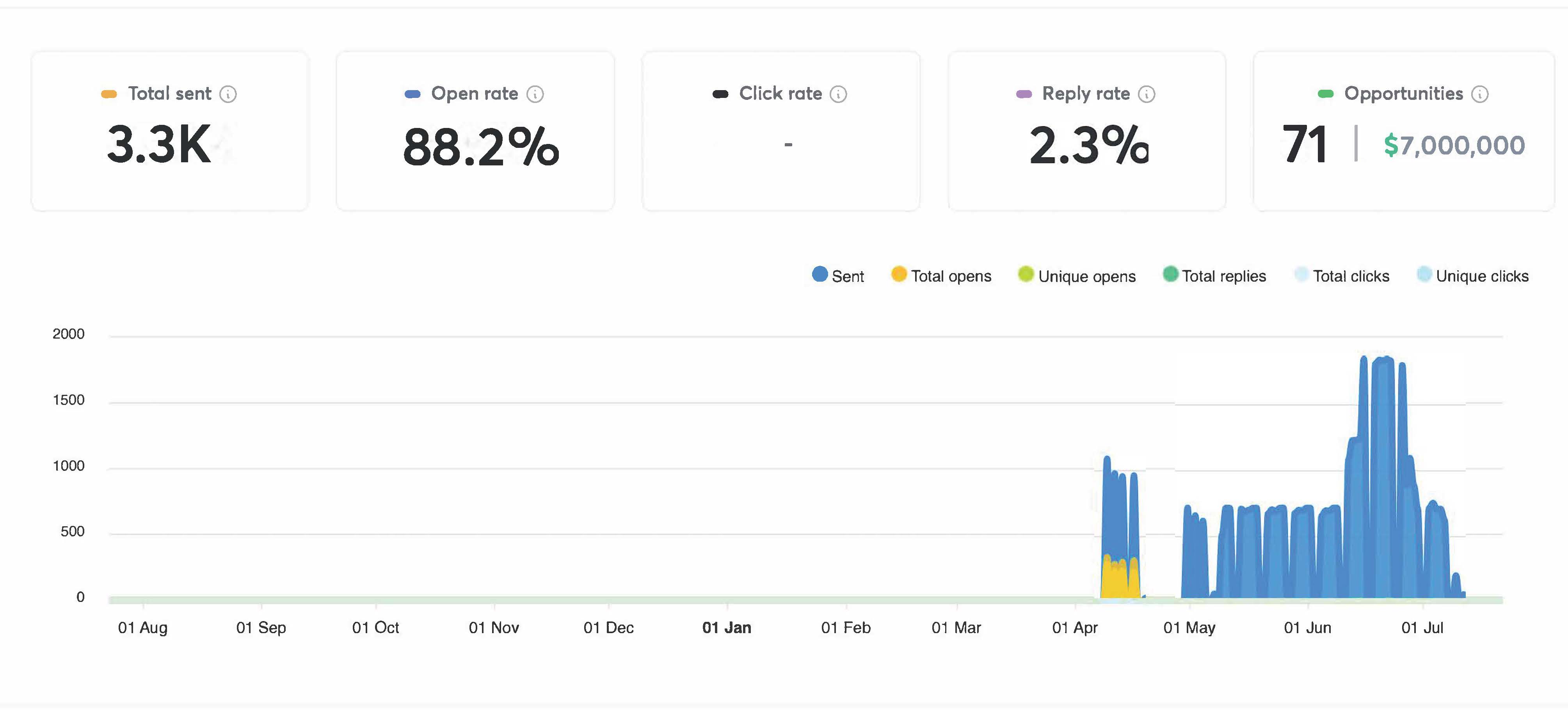

The Impact: Numbers That Speak Volumes

- $8.5M Raised: Secured 45% of target funding in just 3 months

- 68% Meeting Success Rate: Two-thirds of introduced investors proceeded to detailed discussions

- 4.2x Faster: Significantly accelerated the typical fundraising timeline

- 85% Investor Retention: Most introduced investors expressed interest in future rounds

The SocialScape Difference

Our success stems from three core principles:

- Technology-First Approach: Our AI systems process millions of data points to identify ideal investor matches

- Relationship-Centric: We maintain personal connections while leveraging technology

- Future-Focused Strategy: Every engagement builds toward long-term fundraising success

Client Confidentiality

While we maintain strict confidentiality regarding our client’s identity, this case study represents one of many successful partnerships we’ve cultivated in the venture capital space.

Ready to Transform Your Fundraising?

Don’t let traditional fundraising constraints limit your potential. SocialScape can help you:

- Access our extensive network of pre-qualified investors

- Implement cutting-edge fundraising technology

- Build sustainable fundraising infrastructure

Take the Next Step

📅 Schedule a Strategic Consultation

- 30-minute no-obligation discussion

- Custom fundraising strategy review

- Network potential analysis

Schedule Your Consultation Now

Contact our team at partnerships@trysocialscape.co.uk or call +1 (480) 952-6946 or +44 07407 042644